Equity Research Report 1: YTL Power International Berhad (YTLP)

Buy Recommendation

Rating: Buy

Price 20/02/25: £0.6

Target Price: £0.75

Market Cap.(£bn): £4.93

Enterprise Value (£bn): £9.13

Undervalued Metrics & Multiple Catalysts Ahead

Catalysts:

Currently developing the YTL Green Data Center Park within the Kulai Young Estate in Johor. This will be the first data centre campus in Malaysia to be co-powered by on-site renewable solar energy. To date, the first phase of the data center park is operational with construction of subsequent phases in progress.

This positions YTLP ahead of competitors in the space and grants first mover advantage for this type of data-centre, as it is anticipated that the Malaysian government may look to impose higher energy costs for fossil fuel powered activities or water tariffs. YTLP has strong experience in water and electricity markets in Malaysia through its other activities and subsidiaries.

The Malaysian government has made renewable energy, digital transformation, and data centre expansion key national priorities. YTLP stands to benefit significantly from these policies:

Green Technology Financing Scheme (GTFS): The fourth iteration of the scheme, renewed with an allocation of RM1bn (£180m), provides funding for businesses adopting green technologies. YTLP is well-positioned to benefit from this initiative for its renewable-powered data centre operations.

Malaysia Digital Economy Blueprint (MyDigital): The government aims to make Malaysia the regional leader in digital services and data centre capacity by 2030. This is directly aligned with YTLP’s current trajectory in expanding data centre capacity.

Foreign Investment Attractiveness: In the last year, £12.7bn of commitments were made by companies like Amazon, Nvidia, Google, Microsoft, and ByteDance, specifically for data centres in Johor. This reinforces Malaysia’s potential as a growing data hub, with Johor being a key beneficiary.

Current permission for 40 data centres in Johor (22 current, and 8 in construction) but permission for a further 50 centres is in discussion.

Singapore’s tightening regulations on new data centres and the proximity of Johor to Singapore make it an attractive area for continued growth.

YTLP has partnered with Nvidia to be the specialised provider of massive scale GPU based accelerated computing in the Asia-Pacific region. This is one of the first deployments of the Nvidia GB200 Grace Blackwell Superchip in the region.

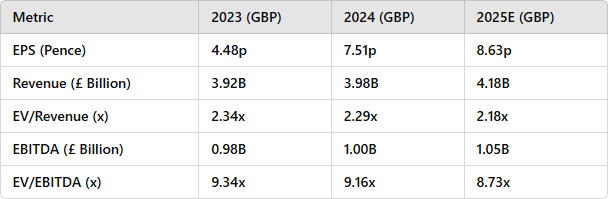

Financial and Valuation Metrics

The £0.75 target price is based on an FY25 EV/EBITDA multiple of 8.73x against data centre company range of 12x-15x. Indicating that YTLP remains undervalued compared to regional peers, especially as we anticipate data centre revenues to grow faster. A DCF analysis with out long-term FCF projections and a discount rate of 6.2%, and a terminal FCF growth rate of 2% also produces an implied share price range of £0.75 - £0.81.

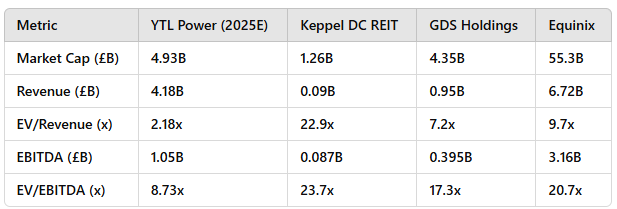

Comparable Public Companies

Region specific players that focus on data centres operations in Southeast Asia in particular Malaysia, China, Singapore, and the Philippines.

From the comparison, we can see that of the comparable public companies, YTLP is undervalued on both EV/Revenue and EV/EBITDA. It is also the most attractive as it has a diversified portfolio of existing subsidiaries in water, power generation, and telecoms, along with a footprint in more stable markets through its Wessex Water subsidiary in the UK. Rather than GDS Holdings and Equinix trading at premium valuations due to their data centre only focus.

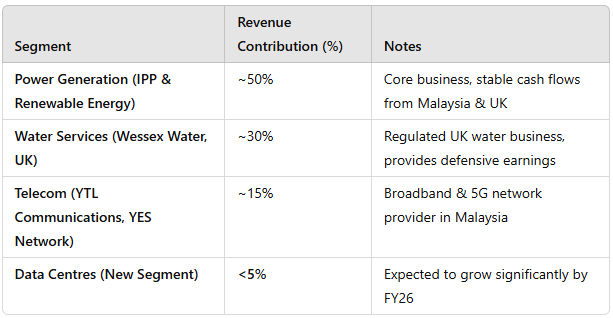

Current Revenue Breakdown (FY24)

YTLP’s data centre revenue is currently small (~<5%) but expected to expand rapidly. If operational capacity grows to 500MW by 2026, this could contribute ~20-30% of total EBITDA.

Phase 1: 92MW operational

Phase 2: 120MW (target: mid-2025)

Long-term target: 500MW (by 2026)

This shifting revenue mix means YTLP is transitioning from a traditional utility company to a tech driven infrastructure leader, which could justify multiple expansion.

Investment Thesis, Catalysts, and Risks

We continue to believe that YTPL is undervalued and that a price correction could occur for the following reasons:

Strategic partnerships: We believe that the company has the ability to expand its strategic partnership with Nvidia in collaboration with the Malaysian government.

YTL Green Data Center Park: First two data centres completed with a joint capacity of 92MW, with a further 120MW to be complete and ready for service by mid 2025.

Cushman & Wakefield market research: A report released has rated Malaysia as the fastest-growing data centre market in Asia Pacific. With their estimates showing a 600% growth in the next five years in operational capacity.

Targeted share prices are as follows:

Bull Case: £0.91 per share based on a WACC of 5.2% and terminal growth of 2.5%. Overachieving against their 500MW goal due to additional partnerships.

Base Case: £0.75 per share based on a WACC of 6.2% and terminal growth of 2%. Hit their 500MW goal, through existing planned growth and partnership with Nvidia.

Bearish Case: £0.6 per share based on WACC of 7.2% and terminal growth of 1%. Issues that affect the ability to meet their target of 500MW.

Investment Risks

The following represents the greatest risks to our investment thesis:

Execution Risks: Project Delays and Cost Overruns

Infrastructure projects face inherent risks such as supply chain disruptions, labour shortages, and construction delays.

While YTLP has met deadlines for initial data centres, the mid-2025 completion target for additional 120MW capacity lacks specificity.

Significant CapEx commitments for data centre expansion could strain debt levels and cash flow if ROI takes longer than expected.

Competitive Risks: Regional and Industry Challenges

Singapore remains the dominant regional hub, and China, Indonesia, and Thailand are increasing competition.

Hyperscalers like Google, AWS, and Microsoft might opt to develop their own proprietary data centres instead of partnering with local firms like YTLP.

Malaysia’s geographic advantage could be eroded by new undersea cable projects that link competing markets.

Macroeconomic & Policy Risks

Interest rate fluctuations impact financing costs for large-scale projects. A rate hike could increase YTLP’s cost of capital.

Carbon emissions and water security regulations may increase compliance costs if YTLP cannot fully rely on its own renewable energy supply.

Geopolitical risks (US-China trade tensions) could disrupt supply chains for critical infrastructure or impact demand for data centre services.

Other company and industry specific risks include (1) Price pressures and overcapacity risk; (2) Management’s ability to execute on new data centres (3) The ability to maintaining governmental support (4) Not keeping up with technological advancements in cooling, energy generation, AI requirements.